If you take the couch potato portfolio route and buy the etfs in equal dollar amounts you ll have a 50 50 portfolio that will be simple to rebalance.

Couch potato portfolio fidelity.

These recipes are formulas for different combinations of funds and bonds that investors can base their portfolios on.

Many years of required minimum distributions.

For example last week we talked about a portfolio recipe from taylor larimore.

Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience.

Couch potato investing simply refers to investing in one of these hands off portfolios with specific recipes.

The couch potato portfolio can be built with 2 etfs.

It earned those returns with only half the money exposed to the stock market.

A latecomer to index funds fidelity plunged forward recently with the introduction of its zero cost funds.

That was over 15 years ago and it has beaten most balanced funds in the meantime.

The original basic humble couch potato portfolio consisted.

Originally the portfolio consisted of just two funds the vanguard s p 500 index fund vfinx and the vanguard total bond index fund vtbmx.

For that reason i m thinking about gradually moving more of our investments over to fidelity since they have physical offices near us.

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort.

To duplicate the traditional asset allocation of vanguard balanced index you ll need to get a bit more complicated and put 60 percent in the equity index and 40 percent in the fixed income index.

I m more inclined to use index funds rather than etfs despite the additional cost but i m having some difficulty finding reasonably low priced and appropriate funds at fidelity for all of your couch potato five fold portfolio.

To be sure 2019 was an exceptional year.

But the basic couch potato portfolio earned at an annualized rate of 9 42 percent over the last three years and at 7 22 percent annualized over the last five years.

For the past 10 years the couch potato portfolio has returned 8 56 with a standard deviation of 9 86.

It is a medium risk portfolio.

The couch potato portfolio is the invention of scott burns a personal finance columnist at the dallas morning news.

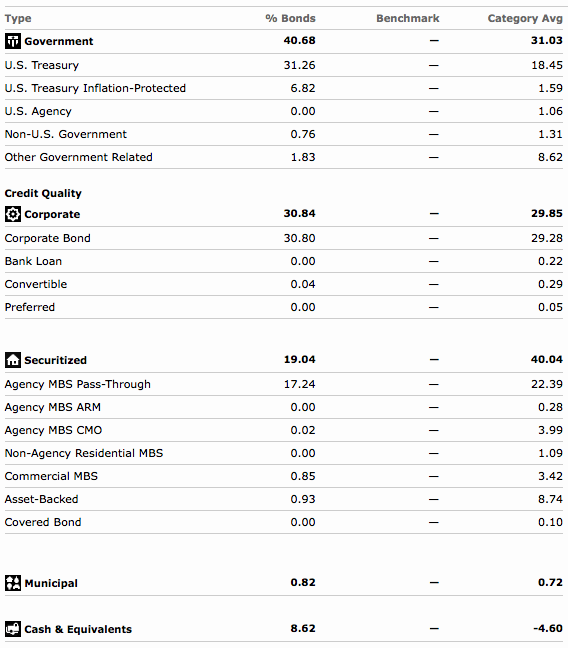

The portfolio is exposed to 50 bonds and 50 equities.

Couch potato portfolios invest equally in two.

Scott burns wrote a 1991 article exactly how to be a couch potato portfolio manager.